What BAS Practitioners Need To Know

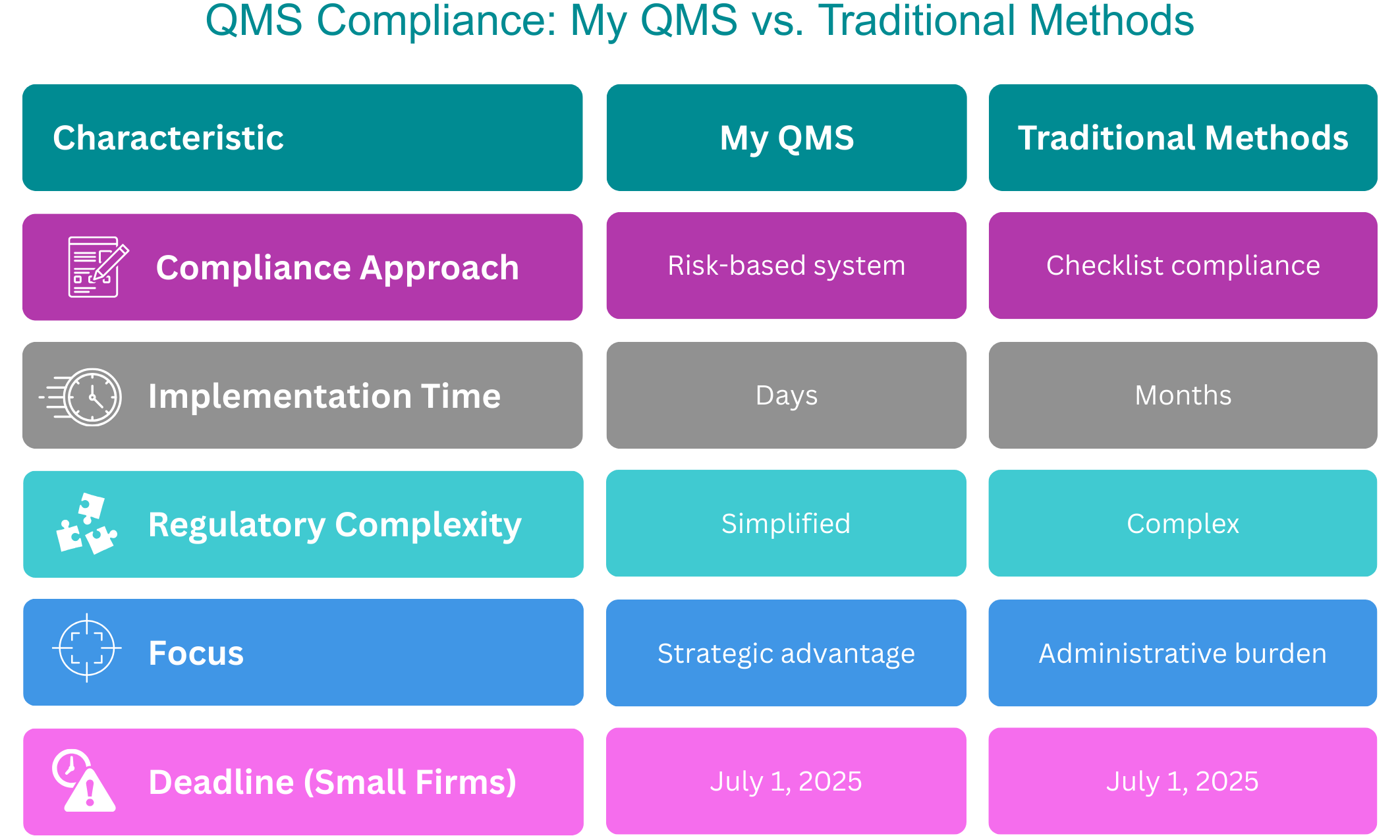

The Tax Agent Services Regime now imposes obligations on registered tax and BAS practitioners to implement and maintain a Quality Management System (QMS). This new rule fundamentally alters how BAS and tax Practitioners must approach compliance. The new mandated obligations place greater responsibility on practitioners to demonstrate compliance with the Code of Professional Conduct. Our Quality Management Solution equips you with a fully functional, risk-based system of policies and procedures that are customisable, scalable, and designed to support ethical service delivery, practice continuity, and ongoing compliance. This is precisely what our My QMS solution delivers with unparalleled simplicity and efficiency.

The Changing Landscape

The Tax Practitioners Board now requires all BAS and Tax practitioners to implement and maintain a Quality Management System. This is just one requirement of the Code of Professional Conduct (Code Item 17). This involves shifting from basic checklists to implementing policies, procedures, disclosures, practitioner caretaker plans, strategic risk identification and much more. All core capabilities built into My QMS’s intuitive digital platform.

Critical Deadlines

While larger organisations must comply by 1 January 2025, smaller practices including BAS practitioner’s have until 1 July 2025 to meet these mandatory requirements. My QMS offers a straightforward path to full compliance, with implementation possible in hours rather than weeks or months. Its a dream system, designed for busy BAS practitioners like you.

Simplifying Regulatory Complexity

This requirement stems from Section 40 of the Tax Agent Services (Code of Professional Conduct) Determination 2024 (the Determination). Rather than wrestling with these complex frameworks yourself, My QMS provides pre-built policies, procedures, forms, templates and workflows specifically designed for BAS Agent practices. All you need to do is customise the system to the unique needs of your practice, and then maintain it.

Don’t let these new requirements become an administrative burden. With My QMS, transform regulatory challenges into strategic advantages while maintaining your focus on a client centric approach to professional service delivery.